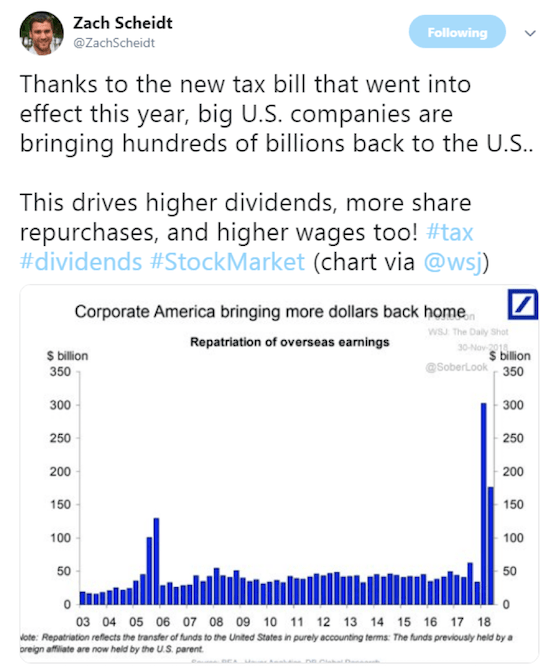

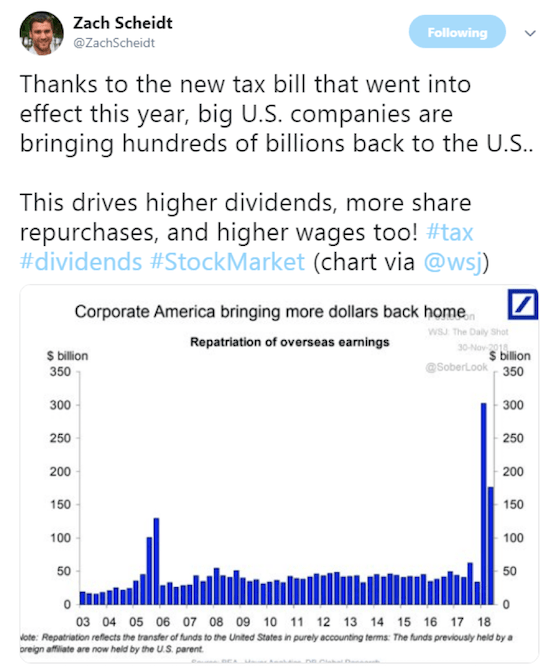

| Tax Bill Ships Billions Back to America Last year at this time, we were getting excited about the new corporate tax cut. As part of this bill, there was a provision that caused hundreds of billions (eventually, the total will be in the trillions) to flow back from overseas to the United States. American companies that do international business typically have to pay taxes to the countries in which they are operating. And then from that point, if they are going to send their profits back to the States, they have to pay U.S. tax as well. In order to avoid paying twice as much in taxes, many companies parked huge sums of cash in overseas bank accounts. Apple for instance had more than $250 billion in cash held in international accounts. That's a quarter trillion just from one single American company! The new tax bill allowed corporations to bring that money back to the U.S., while paying a much lower tax rate. The idea was to provide an incentive for companies to bring this money home, and use it for new growth opportunities. Late last week, I saw a chart from Deutsche Bank that showed how hundreds of billions have been flowing back to the U.S. this year. If you follow me on Twitter, you probably saw my tweet about it.

By the way, if you want to see my day-to-day — actually minute-by-minute — thoughts on the market and our investment opportunities, you can follow me on Twitter here. Just click on the link and then hit "follow" next to my name. With so much cash now back in the States and ready to be used, the question is, "What will executives spend the money on?" Takeover Deals Offer the Best Return One of the best ways that companies will be using this cash is to take over other companies through buyout deals. Here's how a deal like this works... A company with plenty of cash and a strong business might use its cash to buy all of the shares of another company. Maybe that target company has a specific technology that our cash-rich company wants. Or maybe there is a specific brand of clothes or tools or other merchandise that our company wants to sell. By spending cash to buy out this company, American firms can tap into new opportunities and thereby grow their own business. In the first half of this year, we saw a record $2.5 trillion in takeover deals like this announced.1 And as more cash flows back to the States, the stakes are only getting higher. When buyout deals like this take place, the acquiring company buys all of the shares of the company being purchased. And typically the acquiring company has to pay a price much higher than the current market price. After all, if you're an investor in a company getting purchased, and you know another company wants all of the shares, you're negotiating from a place of strength. And you want to get paid a lot for your shares! That's why when a buyout deal is announced, the stock price of the company getting bought almost always jumps sharply higher. Because the buyer has to offer much more to get the sellers to agree to the deal. |

Hi Reader,

Hi Reader,

Hi Reader,

Hi Reader,

The Daily Edge is committed to protecting and respecting your privacy. We do not rent or share your email address. By submitting your email address, you consent to Agora Financial delivering daily email issues and advertisements. Please read our

The Daily Edge is committed to protecting and respecting your privacy. We do not rent or share your email address. By submitting your email address, you consent to Agora Financial delivering daily email issues and advertisements. Please read our

No comments:

Post a Comment